The perfect resource to get your startup going

Your Essential Guide to Launching and Growing a Successful Startup

Startup Glossary

Starting A Company? The Key Terms You Should Know | Startup School

Burn rate, MVP, TAM — if you’re interested in tech and startups, you probably hear terms like these regularly. But what do they really mean? In this episode of Startup School, Managing Partner Dalton Caldwell breaks down some of the most common terminology that you’ll come across in the startup world.

Transcript

0:01 foreign

0:03 [Music]

0:09 I'm Brad Flora I'm a group partner here

0:12 at YC and I'm going to be talking about

0:13 how startup fundraising works today like

0:16 I said I'm a group partner at YC and

0:18 what that means is that I read

0:20 applications I interview the startups

0:23 that apply and then I work with them to

0:25 try to make something people want and Fundraising resources

0:27 one of the topics that people ask about

0:29 all the time at YC is fundraising in

0:32 fact it's probably the thing that we get

0:34 asked about more often than anything

0:36 else and the reason for that is because

0:38 as Paul Graham wrote years ago raising

0:41 money is the second hardest part of

0:43 starting a startup after making

0:44 something people want so let's take a

0:46 quick tour of all the awesome stuff that

0:48 YC's put out about fundraising over the

0:49 years first there's the Paul Graham

0:51 essays he wrote the fundraising Survival

0:53 Guide how to fund a startup how to

0:56 convince investors to invest in your

0:58 company and even wrote a great essay

1:00 about understanding investor herd

1:02 Dynamics all of the stuff's online you

1:04 can see the links below you should check

1:06 it out years later just a little bit ago

1:08 YC president Jeff Ralston posted a

1:11 terrific guide to raising a seed round

1:12 where he covers everything from start to

1:14 finish that you need to know the Nitty

1:16 Gritty on how to raise a seed round and

1:19 he gave a great video presentation at

1:21 startup School a few years ago where he

1:22 presented that material it's on YouTube

1:24 you should check it out it'll tell you

1:26 how to raise a seed round finally we've

1:28 posted a lot of tactical guides about

1:30 specific aspects of fundraising how to

1:33 build a seed deck how to pitch your

1:35 startup how to get meetings with

1:37 investors and how to raise money online

1:39 for startups using platforms like Angel

1:41 list we've even got something about the

1:43 different types of investors and their

1:44 incentives so if you really want to get

1:46 specific and drill into stuff there's

1:48 content for you that you can find what I

1:50 didn't want to do today is just rehash

1:52 all of that stuff because it's already

1:53 out there what I wanted to do instead is

1:56 talk about some of the misconceptions

1:58 and myths that we see as YC Partners

2:01 when we work with Founders Founders out

2:04 there are consuming all sorts of

2:05 information in the media and a lot of it

2:07 is about startup fundraising and there's

2:10 some things in there that just are not

2:11 true that we're going to talk about the 7 fundraising myths

2:13 goal of this talk is to catch you up on

2:15 how fundraising actually works today and

2:17 we're going to do that by exploring

2:19 seven fundraising myths and for each one

2:21 of them we're going to talk about the

2:23 myth the reality behind the myth and

2:25 then look at some great YC companies

2:27 that bust that myth before we get

2:29 started just a little bit more about me

2:31 I'm a YC partner but I've also been on

2:33 both sides of the table as a founder and

2:35 an investor from 2008 to 2014 I was

2:38 building startups and the company that I

2:40 got the most success was perfect

2:42 audience which was an ad retargeting

2:45 startup for small businesses I took

2:47 perfect audience through the YC summer

2:48 11 batch 11 years ago and we raised a

2:52 million dollar seed round after demo day

2:54 I hired a bunch of great people we grew

2:57 to three million dollars in revenue and

2:58 we were acquired in 2014. after that

3:00 acquisition I got really into investing

3:03 in startups it started with Angel

3:05 Investing where I was writing just a few

3:07 checks five thousand dollars ten

3:09 thousand dollars into YC companies that

3:12 I thought sounded really cool at demo

3:13 day but I got hooked the thrill of going

3:16 and meeting Founders finding out what

3:18 their deal is trying to figure out are

3:19 they making something people want should

3:21 I invest was too much for me and

3:23 suddenly I was raising a fund with some

3:25 friends to scale up and invest in even

3:27 more YC companies and so through that

3:29 fund I invested in 150 YC companies and

3:32 the good news for my backers is that we

3:34 got into some great companies you may

3:36 have heard of a few of them deal open C

3:39 retool razor pay it was really awesome

3:41 to help those companies raise their

3:42 first round funding and it's been a lot

3:45 of fun being involved since eventually

3:47 though I joined YC as a group partner

3:49 and I get to do both sides I get act as

3:52 a Founder as a fellow peer to the YC

3:54 Founders and help them figure out how to

3:55 make something people want and then use

3:57 my investor experience to help them

3:59 figure out how to raise money so I've

4:01 got a good view of this I've been

4:02 involved in a lot of seed fundraising so

4:04 let's get started with these myths and Raising money is glamorous

4:06 for the first one I want to talk about

4:07 is this idea that raising money is

4:11 glamorous what's the image in your head

4:13 that you think of when you think of

4:15 startup fundraising for a lot of you it

4:18 might be something like this this is an

4:20 image of Shark Tank and it's a

4:22 television show where entrepreneurs they

4:24 dress up they make a sign they get a

4:27 bunch of materials and they pitch a

4:29 bunch of investors at once called sharks

4:32 and these are a bunch of people of

4:34 varying levels of investor expertise who

4:36 hear the pitch ask a bunch of uh nosy

4:39 kind of pushy questions and then fire

4:41 offers that the founder rapid fire and

4:44 so if you watch this you may be thinking

4:45 gosh I've gotta put a whole presentation

4:48 together like this and I'm gonna pitch a

4:50 bunch of people and they're going to ask

4:51 me all these tough questions and it's

4:52 going to be this high pressure situation

4:54 nation that I've got to figure out the

4:56 reality is that fundraising actually

4:58 looks like this this is a picture taken

5:01 in the creamery which is a now departed

5:04 Cafe in San Francisco notice what's

5:06 happening here it's just a bunch of

5:08 people sitting in chairs talking quietly

5:11 amongst themselves right it's just a

5:13 bunch of coffee chats that's how

5:15 fundraising actually looks that's what

5:17 it actually feels like is just sitting

5:19 in a cafe talking to someone Shark Tank

5:21 the pitch competitions the business plan

5:23 competitions they're just for show

5:25 they're marketing events for the

5:27 organizations that put them on and in

5:29 fact a lot of the investors at these

5:31 things they don't invest they're just

5:33 there to meet other investors and hang

5:34 out and even on Shark Tank I think Mark

5:37 Cuban recently said that even though

5:38 he's put 20 million dollars into these

5:40 companies he hasn't made a dime yet he's

5:42 still in the red actual fundraising is

5:45 just a bunch of one-on-one meetings on

5:47 Zoom over and over again while you try

5:50 to collect checks and convince investors

5:52 It's a Grind okay what you see here is a

5:55 diagram that was made by an actual YC

5:57 company called fresh paint that shows

5:59 what an actual round of fundraising

6:01 looked like for their startup you see at

6:03 the top the company in each one of these

6:05 circles and squares represents a

6:07 different investor that they met with

6:08 and when the boxes are connected it's

6:10 because that investor made an

6:12 introduction for them they met with 160

6:14 investors and 39 of them said yes which

6:17 is a very high conversion rate but the

6:18 check range was all over the place they

6:20 had people write 5K checks and people

6:22 write 200k checks all right not

6:24 everybody with some fancy VC they could

6:26 write a giant check and it took them

6:28 four months and 18 days to get through

6:31 all these meetings and close all these

6:33 deals and that was to raise 1.6 million

6:36 dollars fundraising was painful and it

6:38 was a grind but it was pretty

6:39 straightforward it was just a bunch of

6:41 conversations they've written a great

6:43 blog post that's where this image comes

6:45 from that you can check out should

6:46 definitely read it so great example of

6:49 what it's actually like to raise money The need to raise money before starting a startup

6:51 okay the next myth I want to talk about

6:52 is this idea that I need to raise money

6:55 before I can start working on my startup

6:57 all right we see this a lot with

6:59 Founders we meet people that have a big

7:01 idea which is great and the next thought

7:04 they have is well gosh I guess I need to

7:06 raise money so I can build my big idea

7:08 but that's not how the best Founders

7:10 actually think about fundraising the

7:12 best Founders they build the first

7:14 version of the product first even if

7:16 it's a simple almost toy-like version of

7:20 it and then they go get some users for

7:22 it and then only then when they see that

7:24 people are starting to use it and maybe

7:26 there's some value being created do they

7:28 start thinking about raising money and

7:30 the reason for this is that it's cheaper

7:31 than ever to build a prototype of a

7:33 product to build a first version okay

7:35 it's cheaper than ever to host a website

7:37 and and build software it gets easier

7:39 and easier and easier every year and

7:42 also it's easier than ever to find

7:43 potential users you can get users on

7:46 platforms like product hunt on Hacker

7:48 News you can find users on social media

7:50 Twitter LinkedIn everybody's on the

7:53 internet today and you can use that to

7:55 find early people to try out your

7:57 product and when you do this when you've

7:59 got a little bit of product just a

8:00 little bit and a few users for it it

8:03 immediately gives you a great deal of

8:05 Leverage all right you've gone from that

8:08 person waving the pitch deck around

8:10 trying to figure out how to find 20

8:11 million dollars to someone whose startup

8:14 is in motion and investors want to jump

8:16 on trains that are in motion here's an

8:19 example solugen is a YC company from the

8:22 winter 17 batch and they are a chemical

8:24 manufacturing startup they literally

8:26 make chemicals and sell them as you can

8:29 imagine that is a capital intensive

8:31 business it requires a lot of money to

8:34 build a facility that can make chemicals

8:36 and sell them at scale and a certain

8:38 type of founder that had this idea would

8:41 then make a pitch deck and go around

8:43 telling investors I need 10 million

8:45 dollars I need 20 million dollars to

8:47 build the menu manufacturing plant to

8:49 make these chemicals the solution folks

8:51 chose a different path which is first

8:53 they built a tiny version of their

8:55 reactor that fit on a desk but it worked

8:57 next they built a slightly larger

9:00 version of that that could actually make

9:01 enough hydrogen peroxide to sell and

9:04 they took that to YC when they applied

9:06 for the winter 17 batch and during the

9:09 batch they started making enough

9:10 hydrogen peroxide using this slightly

9:12 larger version of the machine that they

9:15 could go and sell it to First customers

9:17 turned out that hot tub supply stores

9:21 needed hydrogen peroxide to sell the

9:24 people that add hot tubs and so they

9:26

were making ten thousand dollars a month

9:28 selling hydrogen peroxide to hot tub

9:30 supply stores not a ton of money but

9:32

let's step back for a second if you were

9:34 an investor and you were trying to

9:36 invest in a chemical Manufacturing

9:38 Company who would you back the person

9:40 with the pitch deck asking for 20

9:42 million dollars or the people that have

9:44 built a first version of this even if

9:46 it's small and making small amounts of

9:48 the product and selling it to hot tub

9:51 supply stores which is hardly a huge

9:53 business but it's something

9:55 well investors clearly want the second

9:57 Solid Gym is able to raise four million

9:59 dollars for to get started on their

10:01 company because they'd already made some

10:03 progress and today they've since raised

10:05 400 million dollars and they've scaled

10:08 this up to having a full manufacturing

My startup need to be impressive to raise money

10:10 plant let's talk about our next myth

10:12 this idea that my startup needs to be

10:14 impressive to raise money I've got to

10:16 impress people with my startup but my

10:19 startups startup is not very impressive

10:20 so how can I ever do this well the

10:23 reality is you don't need to impress

10:24 investors you need to convince them and

10:28 that's a slightly different thing see

10:29 most startups seem terrible at first and

10:32 in fact the best startups seem the most

10:34 terrible at first so let's take Airbnb

10:38 what was it it was a Marketplace for

10:40 renting an air mattress on someone's

10:42 floor

10:43 terrible idea doordash

10:45 food delivery for the suburbs where it

10:48 takes longer to get everywhere and no

10:50 one's ever started a delivery company

10:51 before

10:52 terrible idea open c a Marketplace for

10:56 selling Collectibles that only exist on

10:58 your computer and can only be paid for

11:01 with magical internet money what but

11:04 investors get this they know that your

11:07 startup is going to sound unimpressive

11:08 early on investors are pretty smart they

11:10 get it and in fact they get bored when

11:12 founders try to impress them okay really

11:15 try to win them over and sell to them it

11:16 bores them about 11 years ago and I did

11:18 YC I had a chance to have a five minute

11:21 meeting with Michael Moritz who at the

11:23 time and it was a partner at Sequoia

11:25 capital is legendary VC and I was so

11:28 excited for this meeting I made a fancy

11:31 deck I practiced all these lines I was

11:33 going to use on him to impress him and

11:35 conv and get him to invest in my startup

11:37 and I sat down with him and I opened my

11:39 laptop to get the slides out and he

11:42 stopped me and just said I prefer to

11:44 just talk about the business you're

11:45 building and I was completely disarmed

11:47

because I wasn't ready for that I was

11:49 ready to impress him not to try to just

11:52 talk about the business that I was

11:53 building and we see this similar

11:55 thinking with a lot of Founders at YC

11:57 where they come to us they don't

11:59 explicitly ask us this but they more or

12:00 less say Brad what are the magic words I

12:03 need to say to make investors want to

12:05 invest in my startup and the reality is

12:07 that it's not about magic words it's

12:09 about making something people want right

12:11 that YC Credo

12:13 it's about making a product getting it

12:16 into users hands and creating some value

12:18 for them and then just explaining how

12:21 there's a one percent chance even just a

12:23 one percent chance that it can get huge

12:25 and using plain simple language to do it

12:28 that's how you convince investors okay

12:30 if investors aren't investing it's not

12:33 because you didn't say the magic words

12:34 it's because your startup isn't good

12:36 enough and you need to make your startup

12:38 better and so have these conversate you

12:40 make your startup better and you just

12:41 explain it to people and talk about it

12:43 like a human and do it over and over and

12:45 over again because again startup

12:48 fundraising is a grind here's an example

12:49 of a company that did a great job

12:51 convincing investors when they met with

12:53 them this is retool and retool makes

12:55 software for building internal tools

12:57 it's a great company they raise their

12:59 seed round you see the founder David and

13:01 one of the CEO and co-founder by just

13:03 meeting a bunch of investors in coffee

13:04 shops in San Francisco I was lucky

13:07 enough to meet with David and he had no

13:08 DAC instead he just opened his laptop

13:11 and showed me the software on his

13:13 computer and he used that early kind of

13:15 crude version of retool to make a crude

13:18 but simple internal tool a little web

13:21 app in minutes

13:22 and then he talked about why his early

13:24 cus

Investor Connect

For entrepreneurs looking to scale their startups, Investor Connect is a vital resource.

Paul Graham's 9-step guide to convincing investors

Be Formidable

Investors often make snap judgements about founders, categorising them as winners or losers

Being formidable is crucial: it menas appearing confidently able to overcome obstackles, not just mere confidence

Be Authentic

Avoid intimating the confidence of experienced founders, authenticity is more effective

Being formidable is crucial: it menas appearing confidently able to overcome obstackles, not just mere confidence

Stick to the truth

Convincing yourself of your startup value is a prerequisite to convincing investors

Your most formidable asset as an inexperienced founder is honesty

Build domain expertise

Being a domain expert is essential to validate your startups potential

Knowledge dept is apparent to investors through your answers to their questions

Wait for the right time

Raise fund not based on your need or deadlines but when you can genuinely convince your investors

Presenting a through-out, honest case for your startup is more effective than buffing or evasion

Demonstrate Market Potential

Investors views startups as potential market dominators, not just innovative ideas

Identify and articulate specific trend of changes that make your startup timely and relevant

Handle Rejection Gracefully

Understanding and articulating why investors might have reservations can strenthen your position

Be candid about rejections and use them to refine your pitch

Pitch with Clarity

Communicate your ideas clearly and concisely, complexity or vagueness is often sees as in competence

Avoid marketing jargon, speak in plain, confident terms that reflects your deep understanding of your business

Follow the Recipe

Undestanding deeply why it's worth investing in

Develop something truely investment-worthy

Communicate this understanding clearly and truthfully to investors

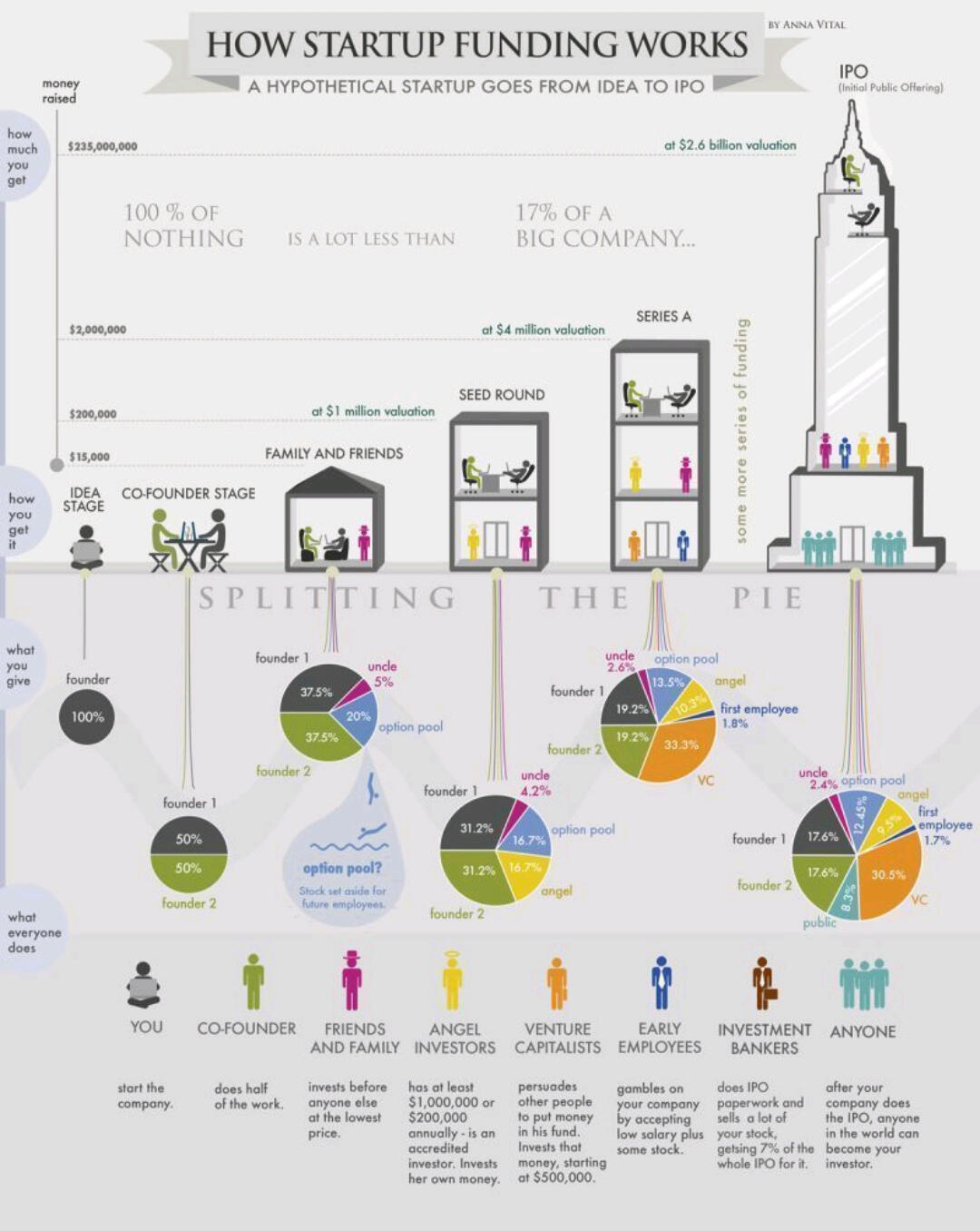

𝐇𝐨𝐰 𝐒𝐭𝐚𝐫𝐭𝐮𝐩 𝐅𝐮𝐧𝐝𝐢𝐧𝐠 𝐖𝐨𝐫𝐤𝐬

This visual breaks down how a startup goes from idea to IPO, showing how ownership and funding evolve at each stage:

𝗜𝗱𝗲𝗮 𝗦𝘁𝗮𝗴𝗲: Founders own 100%, but it's just the beginning.

𝗙𝗿𝗶𝗲𝗻𝗱𝘀 & 𝗙𝗮𝗺𝗶𝗹𝘆: The first investors take a leap of faith at a low valuation.

𝗦𝗲𝗲𝗱 𝗥𝗼𝘂𝗻𝗱: Valuation grows, and so does the pie—early employees and angels join the journey.

𝗦𝗲𝗿𝗶𝗲𝘀 𝗔: VCs start driving growth, and founders’ ownership begins to dilute further.

𝗜𝗣𝗢: A small slice of a huge company often beats owning 100% of a tiny one.

It’s a constant balance between raising the capital you need and managing dilution.

The Anatomy of a Perfect Pitch Deck

Purpose & Vision

State your purpose and vision in a concise sentence

Target Audience

Clarify the specific organisations your serve and their problems

The Problem

Describe the financial, business, and personal issues caused by the problem you solve

The Solution

Present a neat and ordered solution slide

Commercial Model

Ouline your pricing structure for different customers segments

Evidence of Success

List Customers, contract values, and a "bow tie" illustraction fo the client pipeline

Future Growth

Highlight key points from your financial model

Unique Advantage

Explain your unique edge, like a technical moat or distinctive feature

The team

Highlight the teams talent, balance of skills, and future talent attraction plans

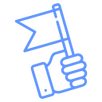

Market Analysis

TAM - Total Addressable Market (global potentail)

SAM - Servieable Available Market (Targeted your segment within your reach)

SOM - Servieable Obtainable Market (Market share you aim to capture )

Market Viability

Demonstrate success in SOM as a credibilty measure

Use SAM as a sanity check and short-term potential indicator

TAM reprents long term market penetration potential

Horizon Mapping

H1 - Leverage existing products with SOM

H2 - Extend into new revenue areas, markets and geographies

H3 - Long Term Stretegic goals, such as new product development

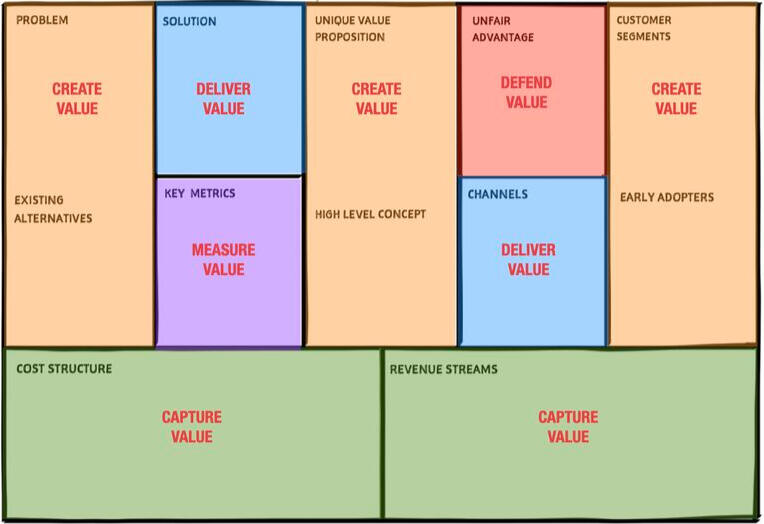

Lean Canvas

Marketing Research

For entrepreneurs looking to scale their startups, Investor Connect is a vital resource.

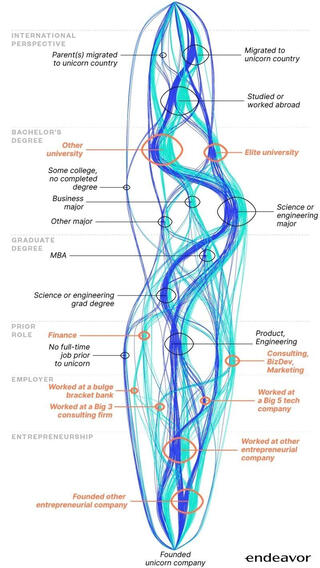

𝗨𝗻𝗶𝗰𝗼𝗿𝗻 𝗳𝗼𝘂𝗻𝗱𝗲𝗿𝘀 𝗱𝗶𝗱𝗻’𝘁 𝗴𝗼 𝘁𝗼 𝗯𝘂𝘀𝗶𝗻𝗲𝘀𝘀 𝘀𝗰𝗵𝗼𝗼𝗹

Unicorn founders did not go to business school, nor did they work at McKinsey. Instead, they were less career-oriented global citizens who typically worked in a startup before they became founders.On average, they had 10 years of work experience prior to founding, mostly within product & engineering, and they almost always lived, worked or studied abroad.

𝗣𝗲𝗿𝗳𝗲𝗰𝘁 𝘆𝗼𝘂𝗿 𝗽𝗶𝘁𝗰𝗵

Title Slide

Company: Make it prominent.

Presenters Name & Title: Establish your credibility

Contact Information: Ensure you can reach out after the presentation

Problem Slide

Identify the Problem: Clearly articulate the problem your target market faces.

Emphasize the need: Highlight why this problem needs a solution how.

Underlying Magic Slide

Technology/Innovation: Share the unique identidy behind your product.

Intellectual Property: Mention patents or proprietary technology, if any.

Demonstration: If possible, include a brief demo to illustrate how your product works.

Value Proposition Slide

Your Solution: Present your product or servicecas the soluttion to the identified problem.

Benefits: Explain how it benefits users and why its better than existing solution.

Business Model Slide

Revenue Model: Describe how you make money (sales,subscription, ads etc.)

Pricing Stretegy: Provide pricing on details tiers, if possible.

Customer Acquisition: Briefly plan how you plan to acquires customers.

Marketing & Sales Slide

Market Stretegy: Outline how you plan to enter and grow in the market.

Sales Channels: Describe direct sales, partnerships, online marketing stretegies, tec.

Customer Relationships: Explain how you build and maintain customer relationships.

Team Slide

Team Overview: Introduce key team members with relevant experiences and roles.

Advisors: Mention advisors or board members who add value to your business.

Competition Slide

Competitive Landslide: Identify key competitors and alternatives in the market.

Differentiators: Highlight what sets you part in terms of product , service or technology.

Financial Projections Slide

Financial Projections: Provide a 3-4 year forecast of revenue , profits and major expenses.

Key Metrics: Share important business metrics (customer acquisition cost, lifetime value, chum rate etc.)

Current Status & Accomplishments Slide

Milestones: Detail what you have achieved for so far.

Timeline: Share your roadmap for the next major milestones.

Use of Funds: Explain how you intend to use the investments.

𝗦𝗲𝗾𝘂𝗼𝗶𝗮’𝘀 𝗽𝗶𝘁𝗰𝗵 𝗱𝗲𝗰𝗸 𝘁𝗲𝗺𝗽𝗹𝗮𝘁𝗲:

Sequoia Capital stands as one of the best Venture Capital funds in history, with investments in renowned startups such as Airbnb, PayPal, and YouTube.The template below is their recommended blueprint for founders seeking to secure funding

How to Determine Your Startup's Market Size?

The cheat sheet attached below will help.

𝗪𝗵𝘆 𝘀𝘁𝗮𝗿𝘁𝘂𝗽 𝗶𝗱𝗲𝗮𝘀 𝗮𝗿𝗲 𝘄𝗼𝗿𝘁𝗵𝗹𝗲𝘀𝘀

“Startup ideas are not million dollar ideas, and here's an experiment you can try to prove it: just try to sell one. Nothing evolves faster than markets. The fact that there's no market for startup ideas suggests there's no demand. Which means, in the narrow sense of the word, that startup ideas are worthless.”“There’s a tremendous amount of craftsmanship in between a great idea and a great product”A lot of people think that a really great idea is 90% of the work, but a great product idea will never turn out as originally conceived.

"It's through the team--through a group of incredibly talented people--bumping up against each other, having arguments, having fights sometimes, making some noise, and working together... they polish each other and polish the ideas. And what comes out are these really beautiful stones."

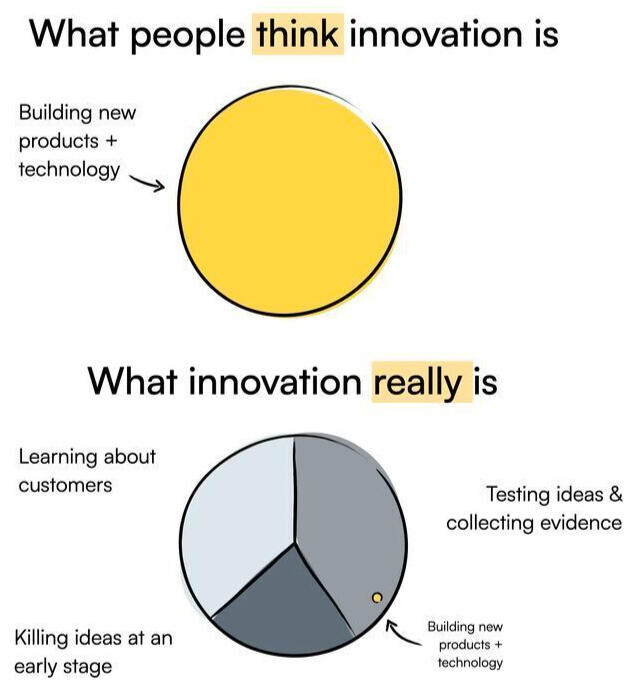

𝗗𝗲𝗯𝘂𝗻𝗸𝗶𝗻𝗴 𝘁𝗵𝗲 𝗺𝘆𝘁𝗵 𝗼𝗳 𝗶𝗻𝗻𝗼𝘃𝗮𝘁𝗶𝗼𝗻

Learning about your customers

Identifying their jobs, pains & gains

Testing ideas & collecting evidence

Reducing risk & uncertainty

Killing ideas at an early stage

Only invest more time and money in ideas

when you have evidence

that they are going to work

𝗡𝗲𝘁𝘄𝗼𝗿𝗸𝗶𝗻𝗴 𝗶𝘀 𝗼𝘃𝗲𝗿𝗿𝗮𝘁𝗲𝗱

Networking is overrated. Go do something great and your network will instantly emerge.

Don’t spend your time doing meetings unless you really, really have to. I really think networking is overrated. There’s all these articles about how you’ve got to network more, and it makes me want to vomit.

Go do something great and your network will instantly emerge. If you build a great product or if you get a good customer base, I guarantee you will get fundext.

𝗛𝗼𝘄 𝘁𝗼 𝗰𝗿𝗲𝗮𝘁𝗲 𝗮 𝗚𝗣𝗧 𝗶𝗻 𝗺𝗶𝗻𝘂𝘁𝗲𝘀

OpenAI CEO Sam Altman reveals how to create a GPT app in under 4 minutes, no coding needed.This marks a major tech shift, enabling anyone to build and sell AI apps.Expect an explosion of new products and solo entrepreneurs in the coming years.

Our Programs

Nam elementum nisl et mi a commodo porttitor. Morbi sit amet nisl eu arcu etiam

faucibus sed etiam consequat sed etiam feugiat.

Product Market Fit

Product-market fit is a crucial milestone for any startup. It refers to the moment when a product meets the demands and expectations of the target market, achieving strong alignment between the value your product

Legal Essentials

For any startup, understanding and addressing the legal essentials is critical to building a strong foundation and avoiding costly mistakes down the road. Proper legal planning not only protects your business

Product Development

Product development is the process of transforming an idea into a market-ready product that meets customer needs, solves a specific problem, and stands out in a competitive market.

Sales & Customer Acquistion

Sales and customer acquisition are critical components of any business's growth strategy. Effectively attracting and converting potential customers into loyal clients requires a combination of targeted outreach,

Digital Marketing

Digital marketing is the promotion of products, services, or brands using digital channels to reach and engage with customers. It has become an essential strategy for businesses of all sizes

Essential Resources for Growing Your Business

Nam elementum nisl et mi a commodo porttitor. Morbi sit amet nisl eu arcu etiam faucibus sed etiam consequat sed etiam feugiat.

Cloud Services Grants

Nam elementum nisl et mi a commodo porttitor. Morbi sit amet nisl eu arcu etiam faucibus sed etiam consequat sed etiam feugiat.

Communities

Nam elementum nisl et mi a commodo porttitor. Morbi sit amet nisl eu arcu etiam faucibus sed etiam consequat sed etiam feugiat.

Business Templates

Nam elementum nisl et mi a commodo porttitor. Morbi sit amet nisl eu arcu etiam faucibus sed etiam consequat sed etiam feugiat.

Success Stories & Case Studies

Nam elementum nisl et mi a commodo porttitor. Morbi sit amet nisl eu arcu etiam faucibus sed etiam consequat sed etiam feugiat.

Nam elementum nisl

Nam elementum nisl et mi a commodo porttitor. Morbi sit amet nisl eu arcu etiam faucibus sed etiam consequat sed etiam feugiat.

Nam elementum nisl

Nam elementum nisl et mi a commodo porttitor. Morbi sit amet nisl eu arcu etiam faucibus sed etiam consequat sed etiam feugiat.

Nam elementum nisl

Nam elementum nisl et mi a commodo porttitor. Morbi sit amet nisl eu arcu etiam faucibus sed etiam consequat sed etiam feugiat.

Contact Us

Nam elementum nisl et mi a commodo porttitor. Morbi sit amet nisl eu arcu etiam faucibus sed etiam consequat sed etiam feugiat.